Senior Life Insurance Company

With Maria Camacho

Maria Camacho | Palmera Group

SOBRE NOSOTROS

Palmera Group fue fundada por María Camacho, es una agencia que va en pro y en función del desarrollo de Agentes de Seguros a Nivel Nacional y en su idioma.

Es tan importante para nosotros que el Agente de Seguros se sienta placido con el entorno y así tener un desempeño eficaz, en todo lo que tiene que ver con un sistema estratégico de ventas, el cual ya se encuentra probado y comprobado por nuestra Agencia.

Sentimos pasión por atender a nuestro Clientes y su satisfacción es la nuestra.

Definitivamente al Asociarnos con Senior Life Insurance Company ha marcado un antes y un después en nuestro crecimiento, hemos entendido como podemos ofrecer a nuestros Agentes no sólo un excelente sistema de compensación, sino la manera como podemos crecer juntos, desarrollarnos profesionalmente y obtener esa Autonomía financiera que todos buscamos, enfocados en la especialización.

Lograr metas trazadas, recorrer un camino juntos, ese acompañamiento necesario para desarrollar Top Producer, Manager, realmente nos apasiona, que nuestros agentes sientan que somos una gran familia!

“El éxito es conocer tu propósito en la vida. Crecer para alcanzar tu máximo potencial y sembrar la semilla que beneficie a otros.”

– JOHN C. MAXWELL

QUE HACEMOS

En primer lugar, somos agentes como usted. Así es: nuestro socio, Senior Life Insurance Company, está dirigido por agentes. No abogados, actuarios, contadores, gurús financieros o cualquier otra persona que nunca haya vendido una póliza de seguro de vida. Los agentes son las personas más importantes aquí, y sin agentes, no existiríamos.

¿Interesado en aprender más sobre nosotros? Haga clic en el botón proporcionado a continuación.

NUESTRO SISTEMA PROBADO

Nuestro sistema es tan fácil que cualquiera puede seguirlo. Con este sistema, puede desarrollar una carrera gratificante, tener la opción de trabajar desde casa y ayudar a las familias de todo Estados Unidos a garantizar la tranquilidad. No se requiere experiencia, y nuestro Home Office está aquí para ayudarlo en cada paso del camino.

Horario flexible. No hay llamadas en frío involucradas. Sí, es realmente así de simple.

- Tomar leads

- Hacer presentaciones

- Ganar dinero

Lo que hace que nuestro sistema sea tan bueno es la simplicidad detrás de él. Tu trabajo es simple. Tome las riendas, haga presentaciones a las personas que solicitaron nuestra información y realice ventas. Esta es una carrera gratificante en la que puedes marcar la diferencia en la vida de las personas.

NUESTRO PROCESO

Nuestra tecnología

Nuestra tecnología innovadora le acerca a los clientes interesados. Utilice nuestro sistema de aplicación sin papel para guiarlos hasta el final. Es así de simple.

Leads the Way

Con la aplicación Leads the Way, los clientes responden a los anuncios nacionales de Senior Life Insurance Company. A partir de ahí, se envían notificaciones en tiempo real a su teléfono. Puede elegir vender al cliente allí mismo por teléfono o recibir instrucciones para llegar a su casa. No tiene que preocuparse por coordinar citas o encontrar nuevos clientes potenciales.

Leads simplificados, la vida simplificada.

La aplicación SLICE

Con nuestra aplicación SLICE, puede enviar negocios directamente a la oficina central. Siéntese y relájese, sabiendo que su negocio se ha enviado al instante y sin errores. Presente y califique a su cliente y elija el mejor producto para ellos. Luego, la aplicación se asegurará de que su aplicación sea precisa. Una vez que su cliente haya firmado, puede enviar su negocio y ser elegible para el pago el mismo día.

Todo a tu alcance. Todo en cinco minutos o menos.

Mentorías ejecutivas

Soporte de oficina

Propiedad de acciones

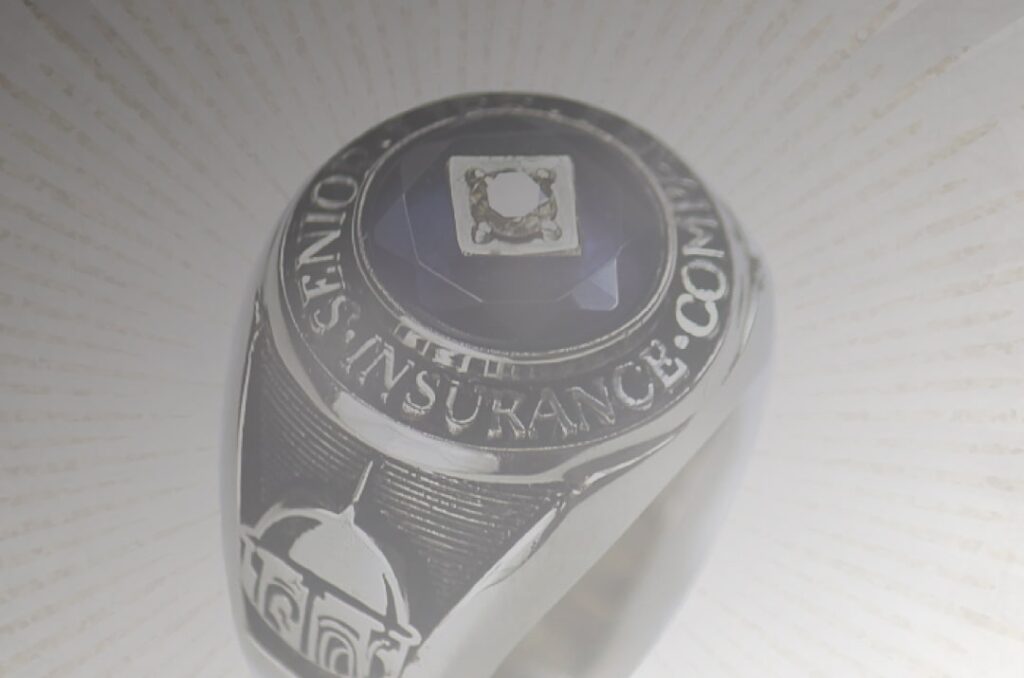

Club de Anillo

Club del Millonario

Club de Rolex

NUESTROS BENEFICIOS

Viaje de incentivo 2023: Por Anunciar

¡Senior Life Insurance Company anunciará su viaje de incentivo para 2023 pronto!

¿Interesado?

¡Conviértete en un agente!

Al enviar mi información, proporciono mi firma electrónica como indicación de mi intención de dar mi consentimiento para recibir información de marketing en el número de teléfono y correo electrónico que he proporcionado.