Our Home Office is here for you.

CONTACT US

COMPANY LEADERS

Our FounderRon Powell | CEO & President | See Ron’s Story

SENIOR LIFE IS BUILT ON PROVEN LEADERSHIP

MITCH CONNERSenior Vice President

Licensed Agent

ERIC MITCHELLSenior Vice President & Treasurer

Licensed Agent

HEATH BASSETTIn-House Counsel

To Be Licensed

OUR EXECUTIVE TEAM HAS OVER

100 YEARS

COMBINED EXPERIENCE IN FINAL EXPENSE

Serving America’s Families Since 1970

We are dedicated to supporting families all over the country during their most difficult times. We offer affordable final expense coverage, and no one under the age of 85 is turned away, regardless of health conditions. We pride ourselves on excellent service, people-focused products, and a speedy claims process. We are here for you when you need us the most.

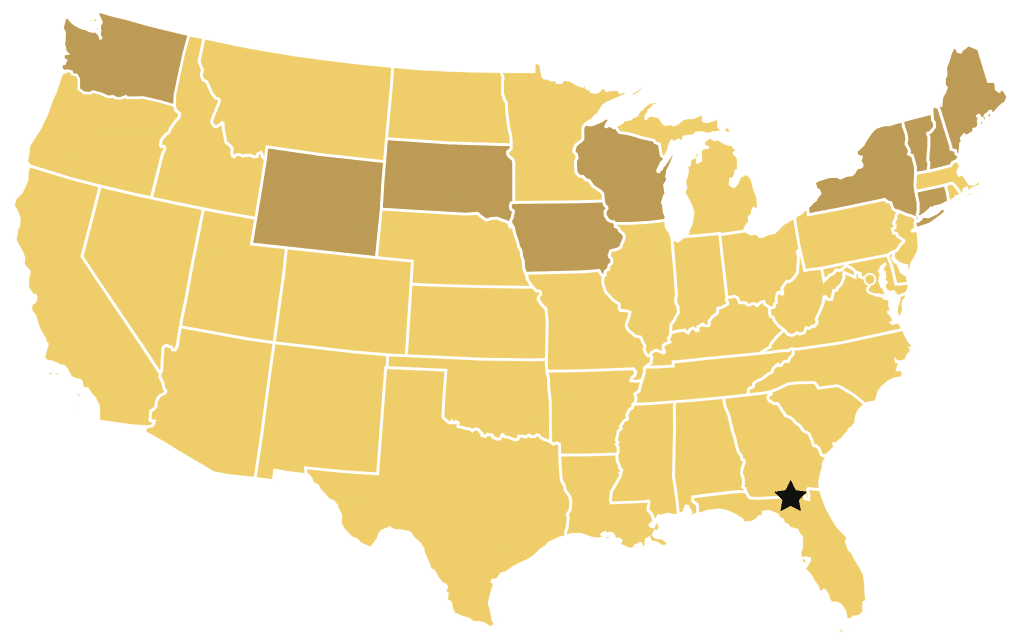

Senior Life Proudly Serves Customers In Over 40 States Plus Washington D.C.

We are licensed in each highlighted state.