We are hiring

- Web Designers

- Graphic Designers

- Social Media Coordinators

- Marketing Interns

OPEN POSITIONS | APPLY NOW

Build Your Career With Us

We’re a small team of marketers looking to grow our team!

At Senior Life Insurance Company, we’re responsible for our company’s story to people all across the country. By joining us, you’ll become a part of Senior Life’s voice as we share our mission to provide affordable life insurance to families in need.

Meet Our Team

“

It’s always been a dream of mine to work with a company and molding the identity of the company with finesse. At Senior Life, I feel like I can do that.

Erick Gonzalez

It’s exciting to contribute my skills and knowledge to a company that gives me the freedom to be creative. I enjoy working with our marketing team because everyone is friendly, supportive, and we work well together. There’s never a boring day in the marketing department!

Logan Lott

Senior Life Insurance Company gives me the opportunity to grow as a designer!

Paige Mitchum

It’s exciting to contribute my skills and knowledge to a company that gives me the freedom to be creative. I enjoy working with our marketing team because everyone is friendly, supportive, and we work well together. There’s never a boring day in the marketing department!

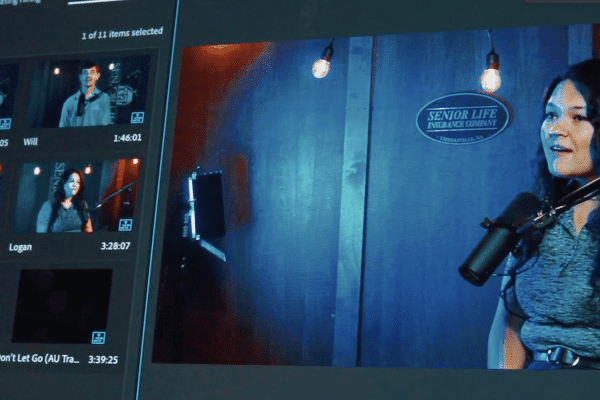

Tashanna Whitehead

My favorite thing about working in the marketing department is definitely my coworkers. It’s a major benefit to be able to work with knowledgeable creatives who I can learn from, depend on, and just have a great time working with.

Cameron Davis

I love working at Senior Life because I get to talk with people from all different walks of life who share my desire to grow! With Senior Life, you have the opportunity to grow with a national company.

Will Voorhees

Open Positions

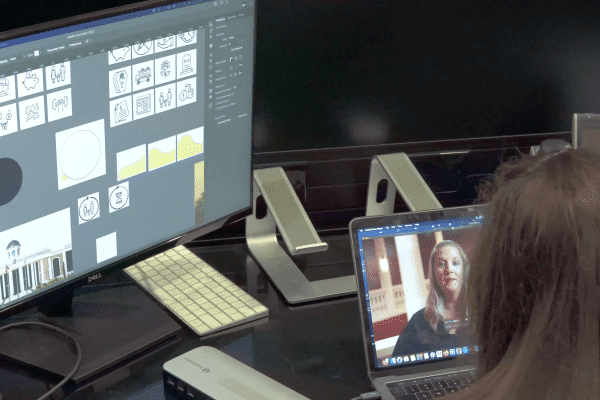

GRAPHIC DESIGNER

Graphic designers are responsible for designing a wide array of media that maintains our company brand. As a graphic designer, you’ll be able to conceptualize and execute the design strategies behind our ad campaigns.

QUALIFICATIONS/SKILLS:

- Bachelor’s Degree/Equivalent Experience (Graphic Design)

- OR a Killer Portfolio!

- Adobe Photoshop

- Adobe Illustrator

- Adobe InDesign

BONUS SKILLS/NICE-TO-HAVES:

- Print Shop Experience

- Photography

- Microsoft Excel

WEB DESIGNER

Web designers conceptualize and create intuitive, engaging, and brand-consistent web experiences for policyholders, agents, and events. Web designers also maintain our applicant tracking system, create email marketing campaigns, and assist with management of Facebook ads and Google ads.

QUALIFICATIONS/SKILLS:

- Bachelor’s Degree/Equivalent Experience (Web Design)

- OR a Killer Portfolio!

- HTML5

- CSS3

- JavaScript

- jQuery

- WordPress

- Adobe Photoshop

- Adobe Illustrator

- Google Analytics

BONUS SKILLS/NICE-TO-HAVES:

- Figma

- SEO Optimization

- Mailchimp

- Google Tag Manager

- CRM/ATS Experience

SOCIAL MEDIA COORDINATOR

Social media coordinators are responsible for planning, implementing, and monitoring Senior Life’s online marketing strategies. Social media coordinators also monitor online traffic and research our target audience to discover trends.

QUALIFICATIONS/SKILLS:

- Bachelor’s Degree/Equivalent Experience (Marketing)

BONUS SKILLS/NICE-TO-HAVES:

- Ad Management Experience: Facebook, Instagram, YouTube, Twitter & TikTok

- HooteSuite

- Analisa.io

MARKETING INTERN

Marketing interns undertake various tasks to assist our graphic designers, web designer, and videographers. We help marketing interns acquire necessary marketing skills as well as the knowledge of various marketing strategies.

QUALIFICATIONS/SKILLS:

- High School Diploma

- Organizational Skills

- Time Management

- Microsoft Office

BONUS SKILLS/NICE-TO-HAVES:

- Interest in Marketing Analytics

- Pursuing Marketing-Related Degree

Grow your talents & develop new skills with us.